You should make use of a property owner insurance binder to show that you have coverage on your house. A binder is usually used when closing on a brand-new house. Common protections in a house owner insurance policy binder consist of home, liability, components, and clinical repayments. Business home insurance binders are called for when getting commercial residential property, such as an office complex, retailer, or storage area (auto).

cheaper insurance affordable cheaper cars insurance companies

cheaper insurance affordable cheaper cars insurance companies

However one of the most usual scenarios where you need a binder are purchasing a new car or closing on a residence. In these cases, if you are not yet fully covered,. You'll need a binder for the duration in between the acquisition date and also when the official files will be offered to you.

Whether it's a homeowners insurance binder or one for a cars and truck, your insurance company can provide the binder quickly (cheaper auto insurance). Not natural disasters are totally covered.

How much time does it require to get an insurance binder? When the insurance company accepts the coverage, you can get a binder within a day.

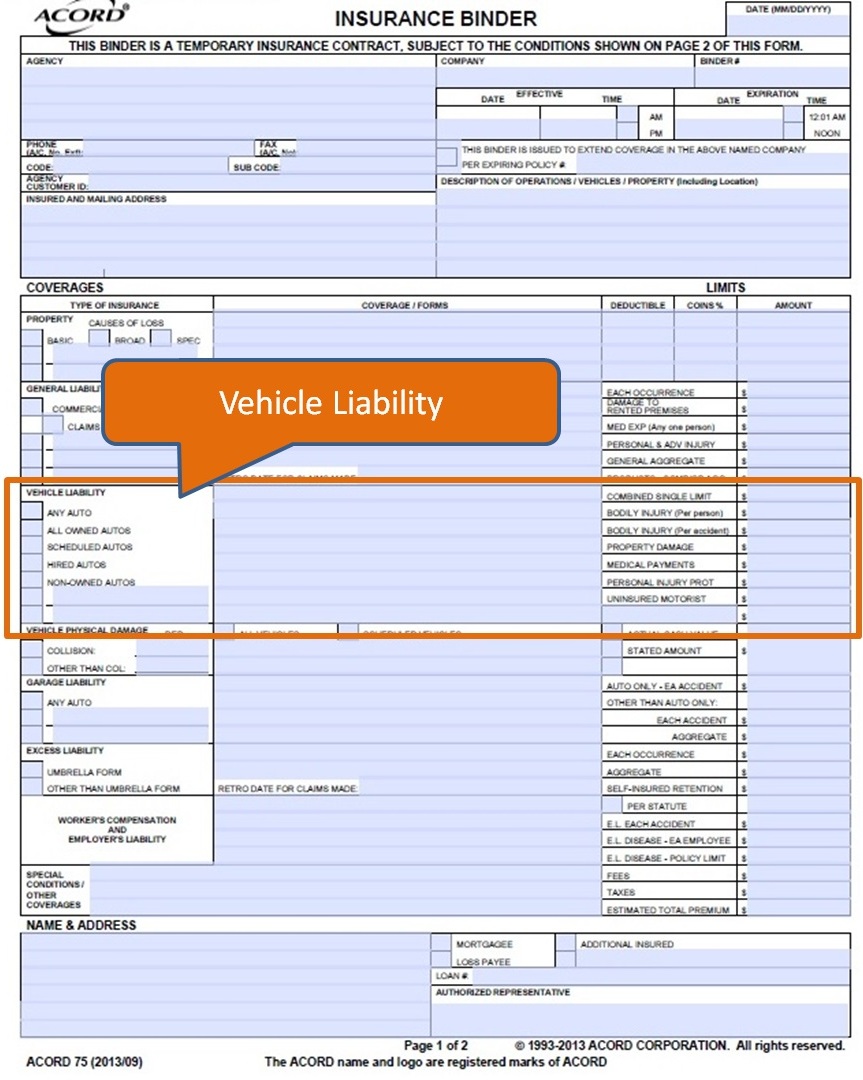

The binder information all the necessary details such as date of enforcement, expiry date, mortgage/lender's information, coverage quantities, and also restrictions. auto insurance. This suffices information for the financial institution to finish the purchase of your condominium. In this situation, the financial institution is securing what it sees as its financial investment in the condominium.

What Does Proof Of Insurance – Stcu Do?

You have actually just gotten a brand-new cars and truck. You have actually financed it via your lender and obtained all the needed papers as well as pertinent information for your insurance coverage. A couple of days later on, you get on the road as well as an additional car sheds control as well as faces you. You endure some injuries, however your automobile is greatly harmed.

You have insurance coverage however do not have the policy in your hand. You're uncertain what to do following. The prices that have stacked up because of the mishap are high. You're unsure if your insurance policy will certainly cover you in this situation. It will. Keep in mind the documents you submitted while getting your cars and truck funded? One of them is an insurance binder.

Insurance binders are 30- to 90-day, temporary insurance policy agreements that confirm you have coverage while you await the main policy records (cheap). Keep reading to learn more about how these binders work as well as how to get one if you require it. When you purchase house owners insurance, it may take a few days for the plan to become final.

auto car insurance affordable cheaper

auto car insurance affordable cheaper

Trick takeaways: An insurance coverage binder is a short-term proof of insurance coverage that is legitimate for 3090 days. Your insurance policy company typically issues the insurance binder immediately.

They function as proof of insurance policy in the event you require documentation of coverage before your formal plan documents are readily available – car insured. Normally, these binders work when acquiring a home or a vehicle that will certainly require repayments, such as with a home loan or various other funding. Please note, these are short-term safeguard that aren't permanent services they're more like history support making certain you will not obtain yourself in trouble prior to your formal papers are offered to you by your insurance policy carrier.

The 5-Second Trick For What Is An Auto Insurance Binder? – 4autoinsurancequote.com

If there is time in between acquisition day and when your official insurance policy files are readily available to you, you'll need to have an insurance coverage binder. How to get an insurance binder If you wind up needing an insurance coverage binder, you'll probably obtain one from your insurance policy company instantly once you acquire a plan (insurance company).

Like Hippo, a lot of insurance business activate your plan the very same day, in cases like these you will not need an insurance coverage binder at all. An affirmation page acts as an irreversible recap of your policy and also is valid throughout the term of your plan.

Ask the representative or manufacturer for something to show that he/she does have complete authority, as well as that the insurer will recognize the regards to the binder. The binder has to be changed by a full plan in 90 days or much less and also the plan need to match (or otherwise problem with) the complete plan when the consumer gets it (car insurance).

Yes, as long as the prepaid funeral agreement was participated in by you before July of 1995. You need to inform the first funeral chapel you want to transfer your pre-paid funds over to an alternative funeral service company (the brand-new funeral chapel) (automobile). The law needs the very first funeral residence to move every one of the profits to the new funeral house, what you paid for to money the agreement, minus the accumulated interest.

car insurance cheap car insurance low cost auto affordable

car insurance cheap car insurance low cost auto affordable

Yes. The Department is able to provide you some general information, however please keep in mind that the enforcement authority for the Do Not Call law (both State as well as Federal) exists with the Arkansas Attorney general of the United States's Workplace. Below is the link to their site for further details; you will certainly require to contact the Customer Defense Department of the Public Security Division: www (vehicle insurance).

How What Is An Insurance Binder? – The Zebra can Save You Time, Stress, and Money.

gov Unlike the Federal Profession Compensation's Do-Not-Call policy, the Federal Interaction Compensation's (FCC) Do-Not-Call Rule puts on the insurance market (vehicle insurance). Insurance policy agents that utilize the telephone or send faxes will have to adhere to the FCC's Guideline as well as examine the nationwide do-not-call checklist also in states that have actually spared insurance agents from their do-not-call policies (like Arkansas!).

A well established organization connection exists where the client has actually purchased or participated in one more transaction within the 18 month period before the call or when a questions or application has actually been made within 3 months before the phone call. However, "chilly" calls to numbers on the Do-Not-Call listing are prohibited unless reveal created authorization has actually been offered to call.

It is the Division's understanding that there is existing complication as to the applicability of the previous state-exception for insurance under the brand-new Do Not Call arrangements. The FCC's web site and get in touch with information is: http://www. fcc.gov/ contacts – business insurance. html A. Yes, life profits are exempt as stated in Ark. Code Ann.

23-79-131. Yes, annuity proceeds are excluded as stated in Ark. Code Ann 23-79-134. A. The quantity of protection would certainly be $300,000, or policy restrictions, whichever is much less. The policies not Helpful site in insurance claim condition would be sold to a solvent insurance provider. The policyholder would certainly receive notification of this, a certificate from the presuming company as well as information regarding where to send out superior settlements, inquire, data claims, and so on.

Ask the representative or manufacturer for something to show that he/she does have full authority, which the insurance provider will honor the terms of the binder (auto). The binder must be changed by a full policy in 90 days or less and also the policy have to match (or otherwise dispute with) the complete plan when the consumer receives it.

Some Known Questions About Insurance Binders For Home Closing Made Easy.

Yes, as long as the pre paid funeral contract was participated in by you prior to July of 1995 (cheap car). You need to inform the first funeral chapel you wish to move your pre paid funds over to a substitute funeral service provider (the new funeral home). The regulation requires the first funeral residence to transfer every one of the earnings to the brand-new funeral house, what you paid down to money the agreement, minus the accumulated rate of interest.

Yes. The Division has the ability to supply you some general information, however please keep in mind that the enforcement authority for the Do Not Call legislation (both State and Federal) exists with the Arkansas Chief law officer's Office. Below is the link to their web site for further information; you will require to speak to the Consumer Security Division of the Public Protection Division: www – vehicle.

gov Unlike the Federal Profession Compensation's Do-Not-Call rule, the Federal Communication Compensation's (FCC) Do-Not-Call Guideline relates to the insurance industry. Insurance